Nowadays if you want to buy a car then there are plenty of ways to do it. You can either pay in cash or you can arrange some form of car finance. If you’re buying a car and are unsure as to the best way to finance it, then look no further. Below you will find all the information you need.

If you’ve already ordered a Premium check and want to know more about the type or details of any outstanding finance then keep reading as we’ve created this handy guide to help:

Cash

Cold hard cash was the only way to pay for a car for decades. Cash is king and it’s still a popular payment method today. However it’s almost unheard of to buy a brand new car with cash these days. Most of the time when people refer to cash during the sale of a new car, they mean bank transfer. The majority of actual cash sales are on lower-value second-hand cars that are sold privately.

When it comes to buying a car, there are many advantages to paying with cash (or bank transfer). Paying by cash or bank transfer is almost always the cheapest way to buy a car. When you buy a car with your own cleared funds it also means that you own the car outright straightaway. This is a good thing because most cars tend to be depreciating assets. This means that you’re losing money on them all the time anyway. When you pay by cash you don’t to pay for the depreciation of the car as well as a finance fee. Buying a car outright also means that you don’t have to shell out every month for it. You already own the car, so you just have to pay the running costs.

Personal Loan Car Finance

Despite the fact that cash is the cheapest way, there are good reasons to finance a car. This is the reason why so many people choose to do so. One way that people finance their cars is to take out a loan from the bank. This is called a personal loan. A personal loan from a bank or building society allows you to buy the car that you want. But you can spread the cost of it over the course of 1 to 10 years.

If you don’t have enough cash to buy a car, then a personal loan is probably the next most affordable way of purchasing one. You still own the car outright from the date of the sale. However your monthly payments might be slightly higher than other finance options. In order to get a personal loan for a car you need to have a pretty good credit rating.

Hire Purchase (HP)

Hire Purchase (or HP for short), is a simple way to finance a car. You pay a deposit when you buy the car, which is typically either 10% or 20%. You then pay for the rest of the car with monthly installments over an agreed period of time.

Unlike using a personal loan to buy the car, when you opt for hire purchase you don’t actually own the car until the final payment in the agreement has been made. The loan is secured against the car, so if you miss any payments then this can be taken away from you. Hire purchase tends to be a more affordable way of purchasing a new car. Make sure you check the rates if you’re buying a used car.

After you’ve paid more than a third of the value of the car to the finance company, then the lender cannot repossess your car without a court order. And once you’ve paid for more than half of the cost of the car, you may have the option to return it and not make any further payments. All agreements are different though so check the contract before signing.

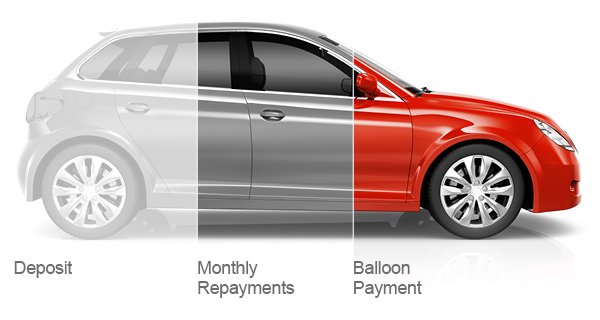

Personal Contract Purchase (PCP)

Personal Contract Purchase, otherwise known as PCP is a more complicated way to pay for a car. It’s similar to HP in that you use the car until the end of the contract. However the main difference is at the end you have a few more options. You can either return the car, pay the resale value and keep it, or use the resale value towards another car on PCP. This is a very popular choice of paying for brand new cars. Which is why you will often see people upgrading their car every two or three years but keeping the same make and sometimes even model of the car.

PCP is a good way to buy a brand new car if you don’t have the money for it. And if you want more options at the end of the agreement. It’s also ideal for those who like to have the latest and greatest cars without having to fork out a big lump sum to buy one. However, when you buy a car with PCP it doesn’t actually belong to you. You are also restricted on how many miles you can drive. Plus you have to return the vehicle in good, re saleable condition. This means that you may have to pay for excess mileage and damage that isn’t classed as wear and tear.

Lease/Contract

The vehicle is still legally owned by the leasing company. If you are buying an ex-lease car then make sure that the lease finance is cleared before purchasing, as you would any other type of financing.

Personal Contract Hire (PCH)

Personal contact hire, also known as PCH is a form of car leasing where you will never own the car. The car’s owner has already made arrangements for the resale of the car when you return it at the end of the agreement. There is very rarely an option to buy the car. Just like with PCP you do not own the car during the agreement, and you have to look after it by keeping wear and tear to a minimum and keeping within your agreed mileage.

Typically when you lease a car by PCH you will have to pay a deposit up front which will equal anything from 1 to 12 times the monthly payment. This is a non-refundable deposit so you need to include it as a sunken cost when you make any affordability calculations. When you buy a car using PCH the reason that you never own the car is because you’re never actually paying for it. The monthly payments only cover the depreciation of the car, and the new owner pays for the rest at the end of your agreement. In a way you are paying to look after the car until it is a few years old. It’s a very popular way of financing cars in the UK because it means that you can drive a car worth £20,000 and only pay £200 a month for the privilege.

Conditional Sale

A Conditional Sale is usually when the vehicle was previously on finance, has now been cleared, but the records have not been fully updated yet to remove the finance fully from the vehicle. Check with the dealer to be sure.

Unit Stocking

If you see “Unit Stocking” in your vehicle check report, this is essentially what many dealers use nowadays to buy vehicles. They will buy the vehicle for sale on finance themselves and then when a customer buys the vehicle from them, they will instantly clear the finance. If you see this on your report, be sure to discuss it with your dealer, check their liability and get confirmation in writing that they will clear the finance on the car you are buying

Demonstration Stocking

Similar to “Unit Stocking” above, this is a type of dealer finance but usually for ex-demonstrator vehicles. Ask your dealer for confirmation that the Demonstration Stocking finance will be cleared prior to you taking the keys.

Bill Of Sale

If your vehicle check says “Bill of Sale”, then unfortunately we won’t have any more information on it, and you will need to contact the finance company or dealer. In a nutshell, if there is a Bill Of Sale on the vehicle then the finance company may have certain legal rights to the vehicle. It’s a complicated area and you would be best adviced to seek advice from the Citizen’s Advice Bureau before purchasing the vehicle

If you have any questions about the Outstanding Finance type on your Premium report please contact us.

My report says Unit stocking the dealer is Saying that they will resolve the finance befor e the car is sold to me what guarantees do I have that this is accurate thank you Sara.